Tax Return Public Records

Routine Access to IRS Records | Internal Revenue Service - IRS tax forms

Copy of a tax return Transcript of your tax return or account Information from open case files Tax-exempt or political organization returns or other documents that are publicly available Tax forms and publications Your tax records Tax Court opinions Internal Revenue Code (IRC) For records not listed here Visit the IRS FOIA Library

https://www.irs.gov/privacy-disclosure/routine-access-to-irs-records

Are Tax Returns Public Record? | Sapling

Tax returns are not public record. Tax returns are not public record; they are private. Tax returns contain confidential information that is not readily available to the public. With the increasing number of online tax filing services, some information is being used and sold publicly, but that is not advocated by the Internal Revenue Service (IRS).

https://www.sapling.com/7844386/tax-returns-public-recordAre tax returns public record? – Sage-Answer

Are tax returns public record? No, tax forms are not public record. They are private information. Tax forms contain confidential information and are not meant to be shared. Information from a tax form can only be revealed to certain persons if there is some legal need to do so—meaning the documents must be necessary to the case.

https://sage-answer.com/are-tax-returns-public-record/

Get Transcript | Internal Revenue Service - IRS tax forms

Order copies of tax records including transcripts of past tax returns, tax account information, wage and income statements, and verification of non-filing letters. Access Tax Records in Online Account You can view your tax records now in your Online Account. This is the fastest, easiest way to: Find out how much you owe Look at your payment history

https://www.irs.gov/individuals/get-transcript

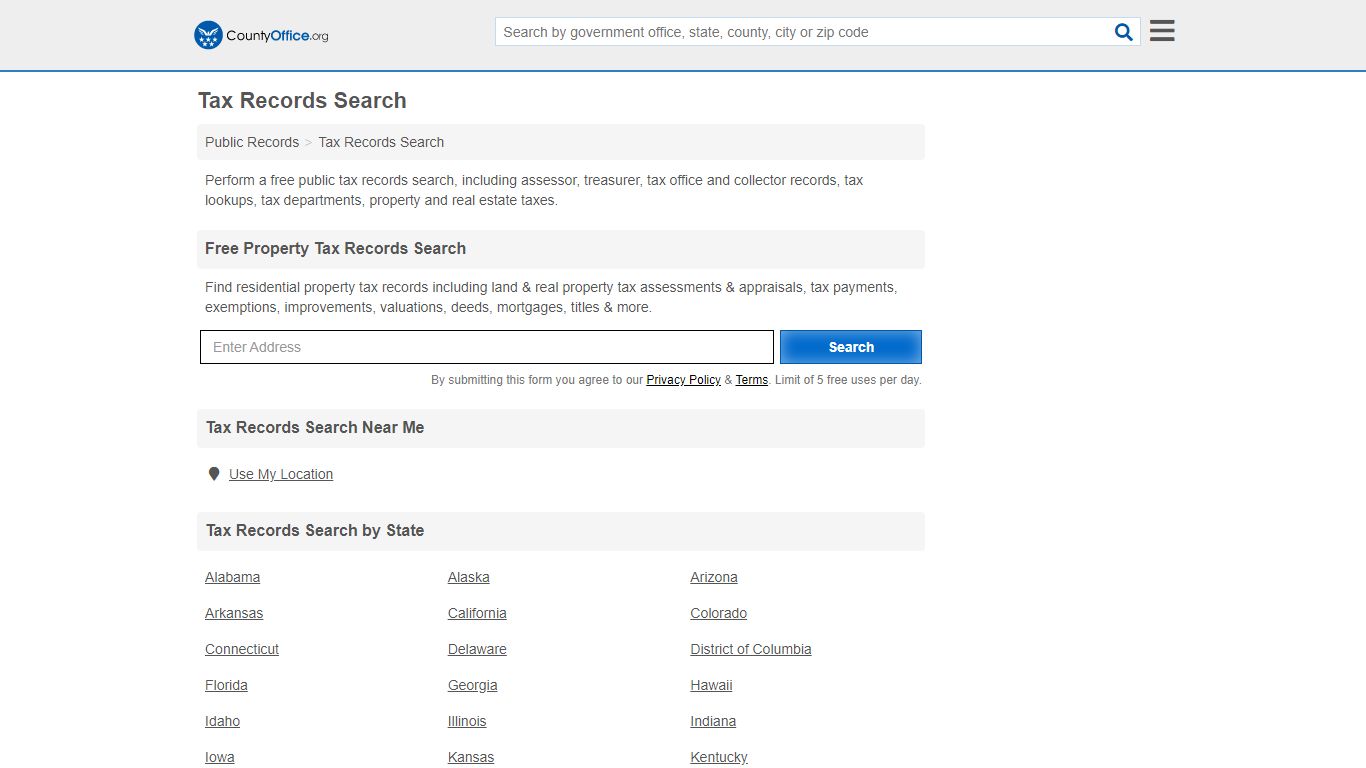

Tax Records Search - County Office

Find residential property tax records including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more. Tax Records Search Near Me Use My Location Tax Records Search by State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia

https://www.countyoffice.org/tax-records/

Nonprofit Tax Returns Public Record: Everything You Need to Know

Making nonprofit tax returns public record allows watchdog organizations to detect corruption so that bad actors can be held accountable. Although the tax records of nonprofit organizations are generally required to be made available to the public, the IRS will not post this information on its site.

https://www.upcounsel.com/nonprofit-tax-returns-public-record

Are tax returns public record? | Legal Advice - LawGuru

Tax returns are not public records. They are actually protected by law and in many cases (for instance, under federal law) it is a crime to disclose tax return information for any reason other than specific and limited exceptions. Answered on 9/01/05, 10:07 am Mark as helpful Kreig Mitchell Law Office of Kreig Mitchell LLC 0 users found helpful

https://www.lawguru.com/legal-questions/missouri-tax-law/tax-returns-public-record-considered-701314696/

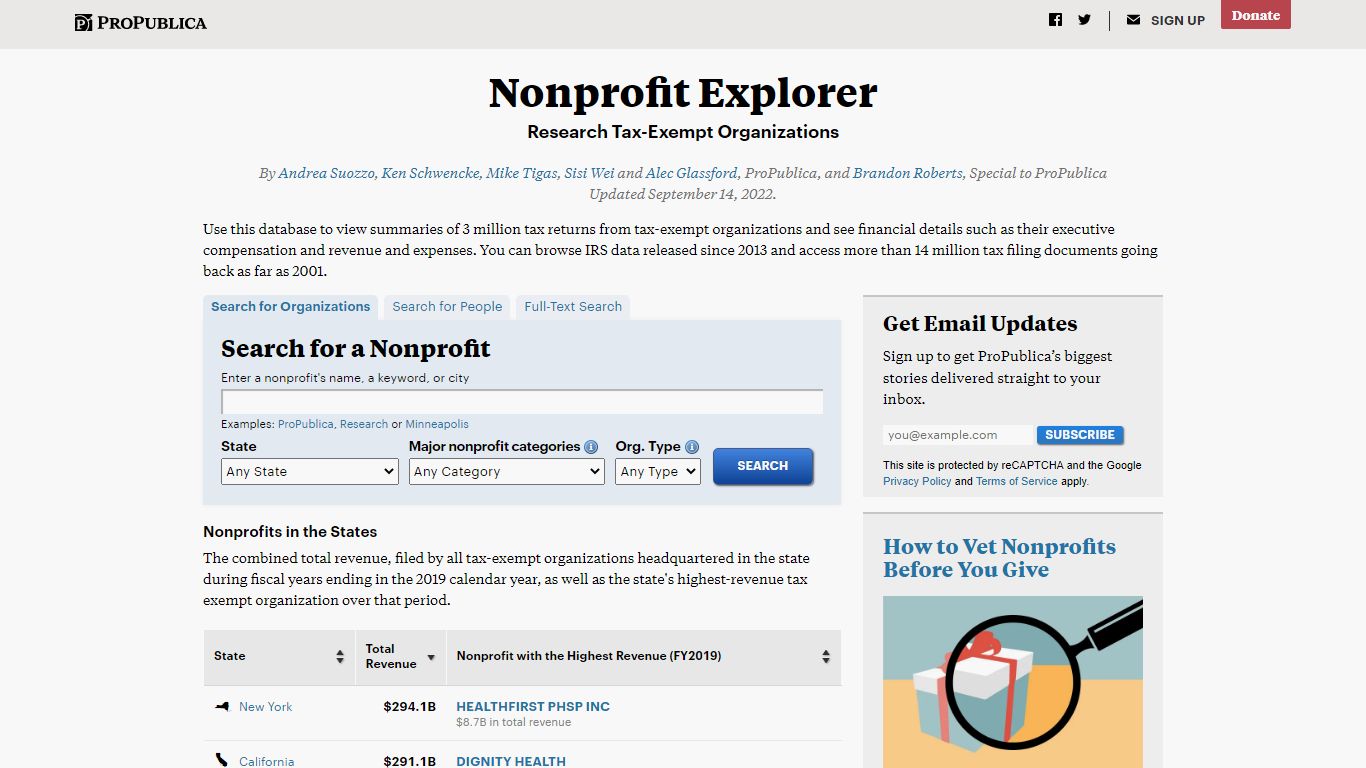

Nonprofit Explorer - ProPublica

Updated July 5, 2022. Use this database to view summaries of 3 million tax returns from tax-exempt organizations and see financial details such as their executive compensation and revenue and...

https://projects.propublica.org/nonprofits/

GuideStar nonprofit reports and Forms 990 for donors, grantmakers, and ...

Easily search 1.8 million IRS-recognized tax-exempt organizations, and thousands of faith-based nonprofits Gather insights on financials, people/leadership, mission, and more Quality. Authoritative data derived from validated sources, including 990s and direct reporting—verified and updated daily

https://www.guidestar.org/